How To Send Your Student To College

For Free WITHOUT Scholarships!

New Strategies For High Income Families

Join Our 2-Day Challenge & Unlock $997 Worth of VIP Bonuses for Just $97

A proven, step-by-step blueprint to fund your child’s college education without ever touching your retirement savings! Protect your future, and secure your child’s college dream—all in 2 power-packed days.

Feeling stuck between being “too wealthy” for typical scholarships yet not wealthy enough to pay college tuition outright? You don’t have to sacrifice your retirement or saddle your student with debt.Our 2-Day Challenge reveals step-by-step how to pay for college WITHOUT scholarships—or draining your savings. Plus, you’ll get $997 in VIP bonuses for just $97.

Our 2-Day Challenge reveals step-by-step how to pay for college WITHOUT scholarships—or draining your savings. Plus, you’ll get $997 in VIP bonuses for just $97.

Event Details

DATE:

April 22nd and 23rd

TIME:

7pm–10pm EST

(Recordings Available You Can't Attend Live)

LOCATION:

Live Online (Zoom)

GENERAL ADMISSION:

$97

Peace of Mind & Smart College Funding—See What Others Say

“I'm Kevin Harrington original shark from shark tank and I recommend these strategies. I wish I knew you when I was going to school.”

“Working with College Funding Secrets just really did give me peace of mind and it was also really nice to know that whatever dollars we were setting aside for college we’re also compounding overtime. So we were actually MAKING money.”

“College Funding Secrets is really just trying to make sure that parents understand that anyone can send their child to college… and the college that they want.”

“The College Funding Secrets plan has given my wife and I peace of mind and security in knowing that we’re going to be able to send both of our kids to college and also be able to retire.”

“I never thought I could keep my college savings and allow it to keep earning interest."

“Having a real plan for college costs gave us peace of mind and freedom we never thought possible.”

“I regret waiting so long to check this out—it's been a total game changer for our family.”

“I was amazed at how simple and beneficial it is—I’m so glad I found this approach.”

“Why did I not know this existed before now?”

For Just $97, You’ll Get Everything You Need to Fund Your Child’s Education—Plus $997 in Exclusive Bonuses

In previous challenges, participants have paid $0—but didn’t receive the private client support and advanced implementation help. Now, for a one-time investment of $97, you get ALL of this:

2 LIVE Training Sessions (Over Two Days)

.

Day One: The Foundation—why you must protect your retirement, plus immediate income ideas.

Day Two: The Blueprint & Beyond—advanced strategies to scale your income, master your mindset, and secure long-term financial stability.

Access to the recordings

Free Custom Financial Evaluation and Your Own Dedicated College Funding Support Representative

.

You will be matched with one of our College Funding Specialists who will analyze your personal situation and deliver your a customized 21-page report.

Get a tailored plan for using The Retirement Scholarship Strategy to cover tuition and protect your nest egg.

Meet one-on-one with your support rep to get the most personalized support

Enjoy unlimited support for your entire family—even if you have multiple children—or whenever your situation changes.

Once you complete your survey so we can get to know about your specific situation, you will book your 1-on-1 meeting with your specialist.

Instant Access to Our Private Client Group (Normally $997)

.

Comprehensive College Funding Support:

Be a part of our Private Client Group (See more information about this below)

Comprehensive College Funding Support

Private Client Group

It gives you everything you need to implement the strategies to reduce the cost of college at an incredible value.

#1: How To Calculate Your 3 Costs Of College Using Our Proprietary College Cost Calculator

#2: How Your Student Aid Index Number Is Calculated To Determine Your Financial Aid Eligibility using our

Financial Aid Calculator And College Search Software

#3: Weekly LIVE Expert Coaching Calls

Get immediate answers and expert guidance from our team every week, including:

Lance Morgan ("Ask Me Anything"): General Q&A across all college funding strategies.

Education Consultants (Secret #1): FAFSA/CSS, financial aid forms, award appeals, school selection, and SAI reduction strategies.

Certified Student Loan Planner (Secret #2): Loan strategies, repayment strategies, loan forgiveness, and borrowing efficiently.

College Funding Specialists (Secret #3): Retirement Scholarship Strategy to save and fund college without impacting retirement.

Retirement Restoration Expert (Secret #4): How to increase retirement income, tax efficiency, and financial planning.

CPA Tax Professional (Tax Strategies): Tax strategies to lower income tax, increase financial aid, and questions related to repositioning assets.

#4: On-Demand Advanced Training Library

Dive deeper into specific topics anytime with expert-led training sessions available instantly.

#5: Searchable Archive of All Coaching Calls

Can't attend a live session? No problem—every coaching call is recorded, searchable, and easy to access by topic and date. Get support anytime, at your convenience.

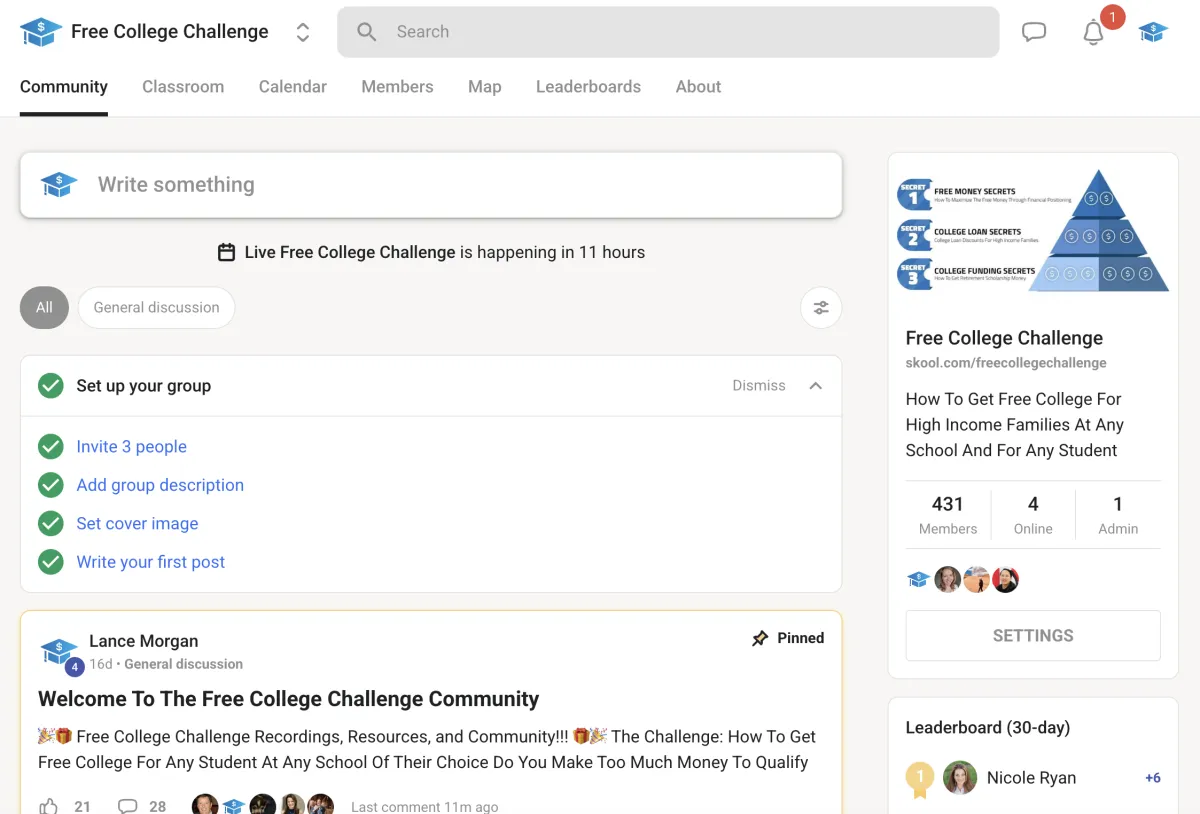

#6: Private Skool Community

Connect, collaborate, and get ongoing support from other smart, motivated parents and our college funding specialists.

Ask questions, receive personalized coaching, and stay on track even after the challenge.

Live interactions so you get immediate answers to your pressing questions.

Join a thriving community of parents who share insights, cheer each other on, and hold each other accountable.

Here Is The Schedule For The Private Client Group:

LANCE MORGAN

Ask Me Anything

Monday at 4pm EST

EDUCATION CONSULTANTS

Secret #1

Monday at 5pm EST

Certified Student Loan Planner

Secret #2

Tuesday at 11am EST

College Funding Specialists

Secret #3

Wednesday at 5pm EST

Retirement Restoration Expert

Secret #4

Wednesday at 12pm EST

CPA Tax Strategist

Tax Strategies

Thursday at 11am EST

TOTAL VALUE: $997 + (the Challenge itself):

But Today, Get It All for Only $97!

DAY 1

The Foundation

1. The High Cost of “Borrowing from Yourself”

Why tapping into retirement accounts for college can create long-term financial strain.

Eye-opening data on how depleting your nest egg can jeopardize your future.

2. A Fresh Approach to Funding College

Introduction to a new income-generating strategy designed with busy parents in mind.

How this approach differs from typical “side hustle” advice—and why that matters.

3. Success Stories That Prove It Works

Real parents who used these methods to pay for tuition without draining their retirement.

The specific steps they took and the impact on their family’s finances.

4. Where to Find the Money

Practical ways to start bringing in extra income—even if you’re on a tight schedule.

An overview of hidden opportunities most parents overlook.

5. The Community Advantage

How a supportive network of like-minded parents keeps you motivated and accountable.

Why you don’t have to do this alone.

WHY ATTEND DAY ONE?

Gain Clarity: Understand exactly why you need to avoid touching retirement funds—and the real risks if you do.

Immediate Wins: Walk away with tangible, actionable steps you can start right after Day One.

Inspiration: See proof that this works for parents just like you, giving you the confidence to move forward.

DAY 2

The Blueprint & Beyond

1. The Complete Income Blueprint

A step-by-step roadmap to build a consistent stream of income for college costs.

Strategies fit for full-time workers, stay-at-home parents, or anyone in between.

2. Identifying & Selecting the Right Opportunities

How to pick the best income ideas based on your unique time, skills, and goals.

Avoiding the “shiny object syndrome” by focusing on what truly moves the needle.

3. Scaling & Automating Your Results

Advanced tips for turning a small side income into a significant cash flow engine.

Effective time management so you’re not working 24/7.

4. Mindset Mastery & Overcoming Roadblocks

Addressing fear and limiting beliefs around money and entrepreneurship.

Staying motivated—even when life gets hectic.

5. Q&A + Action Plan

Live coaching to tackle your biggest challenges.

A clear roadmap for the next 30, 60, 90 days to ensure your child’s college is funded—without sacrificing retirement.

WHY ATTEND DAY TWO?

Depth & Details: Get the in-depth how-to and advanced tactics that turn small gains into big results.

Personalized Guidance: Bring your questions for live Q&A and overcome your specific roadblocks.

Long-Term Security: Discover how to keep growing and protecting your retirement, even after college is paid.

Who This Challenge Is For

For: Parents who want real solutions to college funding, not gimmicks or loans that drain retirement.

For: Families ready to take action and embrace new financial opportunities.

Not For: Those looking for “get-rich-quick” schemes or unwilling to put in any effort.

No-Risk Guarantee

If you attend the full 2-Day Challenge and feel you didn’t learn how to save at least $25,000 off the cost of attending college and attend a week of our daily calls, just email us at [email protected] within 14 days for a full refund.

Ready to Transform How You Fund Your Child’s College Education—While Protecting Your Retirement?

This 2-Day Challenge is your fast-track to a proven system for making extra income, securing tuition, and preserving your nest egg. Remember, we’re also including $997 worth of VIP bonuses—yours FREE when you join today at $97.

Free Custom Financial Evaluation

Expert Implementation Support

Copyright © 2025. College Funding Secrets. All Rights Reserved.